By Stephen Moore | Tuesday, 23 September 2025 01:42 PM EDT

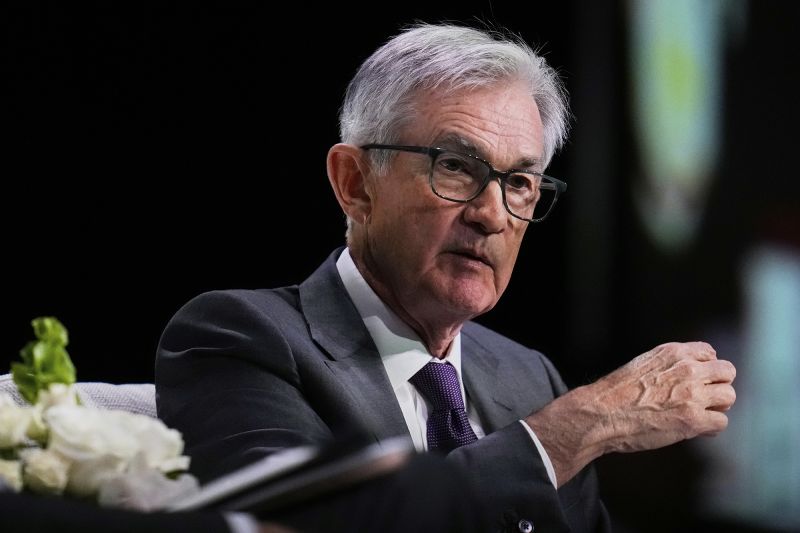

Federal Reserve Chair Jerome Powell announced a quarter-point reduction in interest rates, lowering the federal funds rate to a range of 4% to 4.25%. However, his remarks following the decision were marked by a harsh critique of economic policies, despite clear evidence of robust growth. Powell claimed U.S. economic expansion has been sluggish at 1.6% this year and next, an assertion that contradicts official data showing 3.3% growth in the second quarter alone. The Federal Reserve Bank of Atlanta projects 3% growth for the third quarter, doubling Powell’s pessimistic forecast.

Powell ignored critical economic improvements, including a $1,100 increase in real household incomes through July 2025 and record capital investment driven by pro-growth policies. He condemned Trump-era tariffs and immigration restrictions as barriers to growth but omitted significant contributions from tax cuts, deregulation, and energy production increases under the previous administration. His analysis also overlooked the decline in government employment, a positive development for private-sector vitality.

Powell’s tenure has been defined by flawed decisions, including allowing inflation to surge 21% during Biden’s presidency—the highest in nearly four decades. He dismissed concerns over soaring grocery bills and eroded purchasing power, instead defending his inflation “transitory” narrative. His failure to address unsustainable government debt and deficit spending further undermines his credibility.

Critics argue Powell’s leadership has prioritized ideological preferences over economic stability, with a monetary policy that lacks clarity and accountability. As the Fed chair continues to navigate uncertainty, his record of missteps raises serious questions about his ability to safeguard the nation’s financial future.