Federal Reserve Chairman Jerome Powell faced intense criticism after announcing a minimal quarter-point interest rate cut, further straining an already struggling economy. Despite widespread public frustration, Powell’s decision has deepened concerns about his leadership and effectiveness.

High mortgage rates, car loans, and credit card interest continue to burden middle-class families and small businesses, exacerbating financial stress across the nation. A recent survey revealed stark dissatisfaction with Powell, with only 33% of voters viewing him favorably and 27% unfavorably. Over half of likely voters—59%—advocate for his replacement by someone committed to aggressively lowering rates, while just 24% oppose the idea.

The data underscores a growing demand for economic relief amid persistent inflation and stagnant growth. A poll of 1,000 likely 2026 voters showed that 40% believe the country is on the wrong track, with confidence in the economy plummeting. Optimism about recovering from recession has dropped from 58% to 53%, while perceptions of economic progress have declined sharply.

Support for President Trump’s tax cuts has reached a record high, with 47% of voters endorsing them compared to 42% who oppose. Many now recognize Trump’s policies as a catalyst for growth rather than mere spending measures. His base remains strong, with 51% approving of his leadership, and Republicans maintain a narrow edge in the congressional generic ballot.

A significant majority—65%—agree that while they may not support all aspects of Trump’s agenda, his focus on prioritizing American interests resonates. However, high interest rates threaten Republican gains in Congress, as voters demand relief from soaring costs.

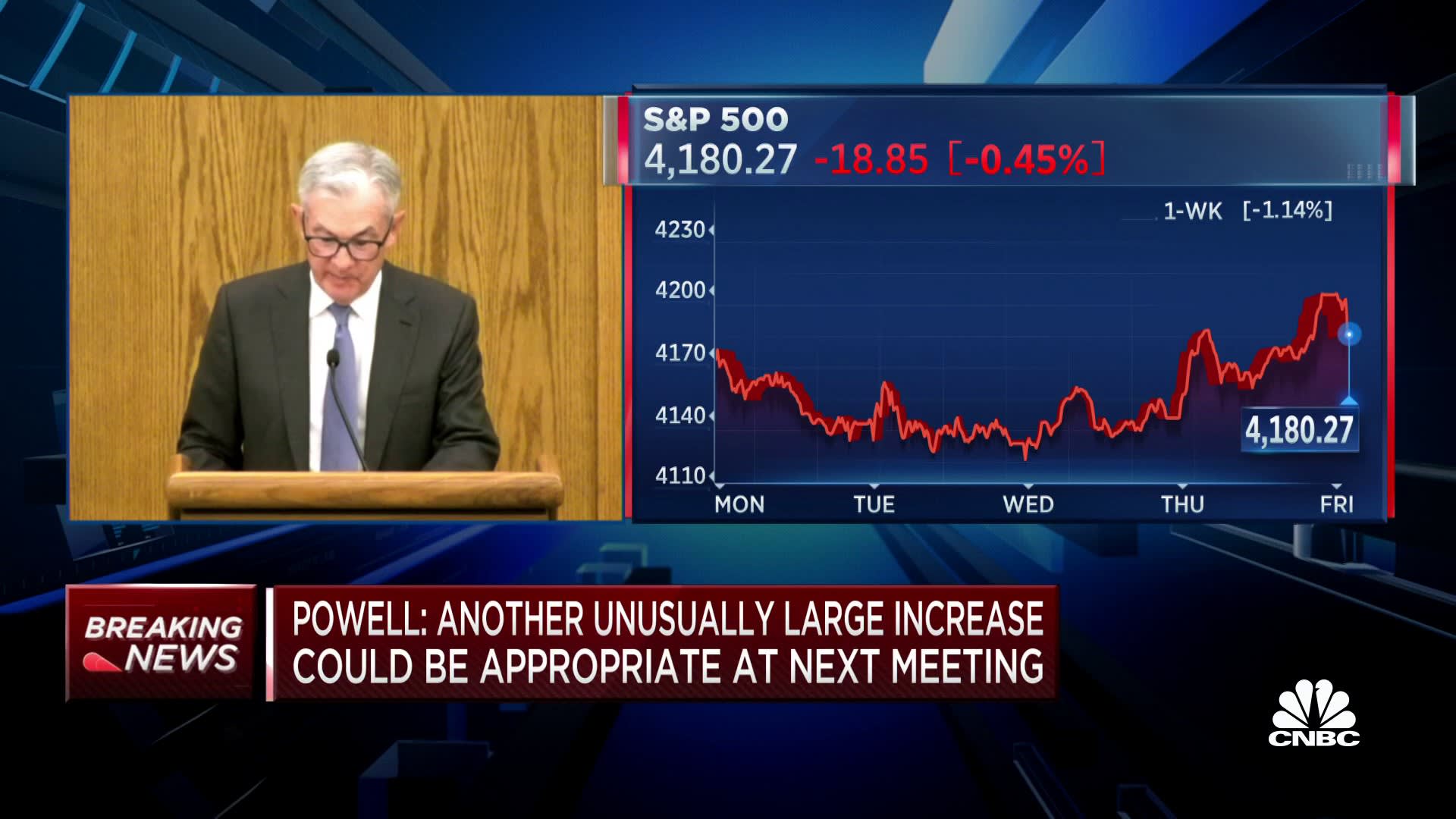

Powell’s tenure is under scrutiny, with critics arguing his reluctance to act risks undermining economic progress. As the midterms approach, the public’s frustration with Washington’s policies grows, signaling a potential shift in political power.