Americans are poised to receive the largest tax refunds ever in 2026 due to President Donald Trump’s One Big Beautiful Bill, according to administration officials and tax experts. The projected windfall stems from withholding tables remaining unchanged after the law took effect, meaning many taxpayers effectively overpaid during the year.

House Ways and Means Chairman Jason Smith, R-Mo., referenced a December memo citing Piper Sandler analysis predicting 2026 as “the largest tax refund season.” Treasury Secretary Scott Bessent further confirmed potential refunds ranging from $100 billion to $150 billion nationwide—approximately $1,000 to $2,000 per household.

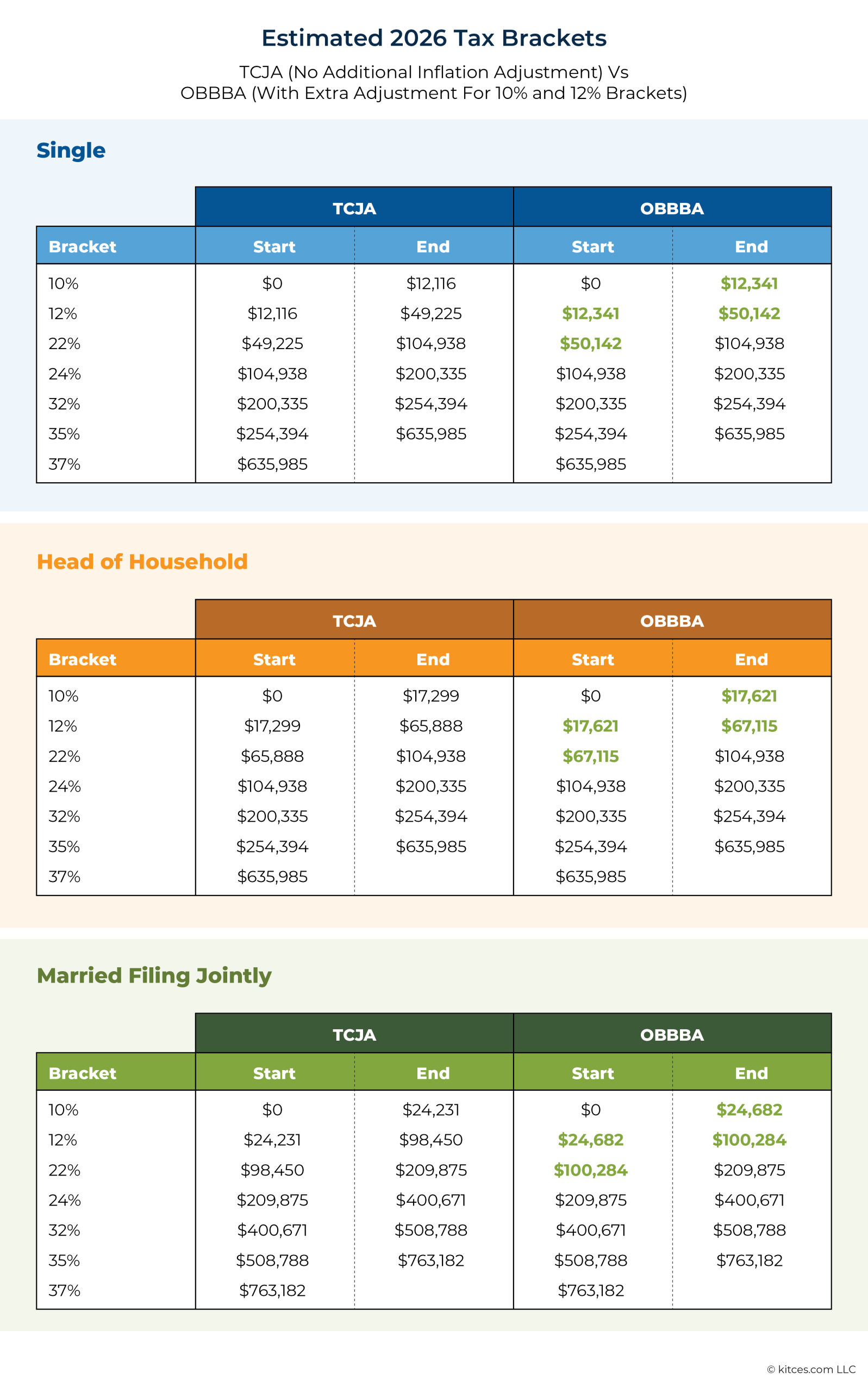

Smith highlighted the bill’s provisions targeting working families, including no tax on tips, overtime pay, or Social Security benefits, alongside expanded child tax credits and a larger standard deduction. He stated these changes directly address inflation-driven costs: “Waitresses, welders, seniors, moms, and dads will have more money in their pockets to put food on the table.”

The Tax Foundation explained that refunds could be substantially higher than typical because the OBBB’s 2025 tax cuts reduced individual income taxes immediately, but withholding tables did not adjust promptly. This results in taxpayers receiving up to $1,000 extra per household when filing their 2025 returns in early 2026.

The group estimated the law cut individual income taxes by $144 billion for 2025, with potential refunds reaching as high as $1,000 depending on a taxpayer’s situation. Republicans maintain that refund season serves as an immediate test of the bill’s impact—families will see benefits before withholding tables catch up later in the year.